Taxes

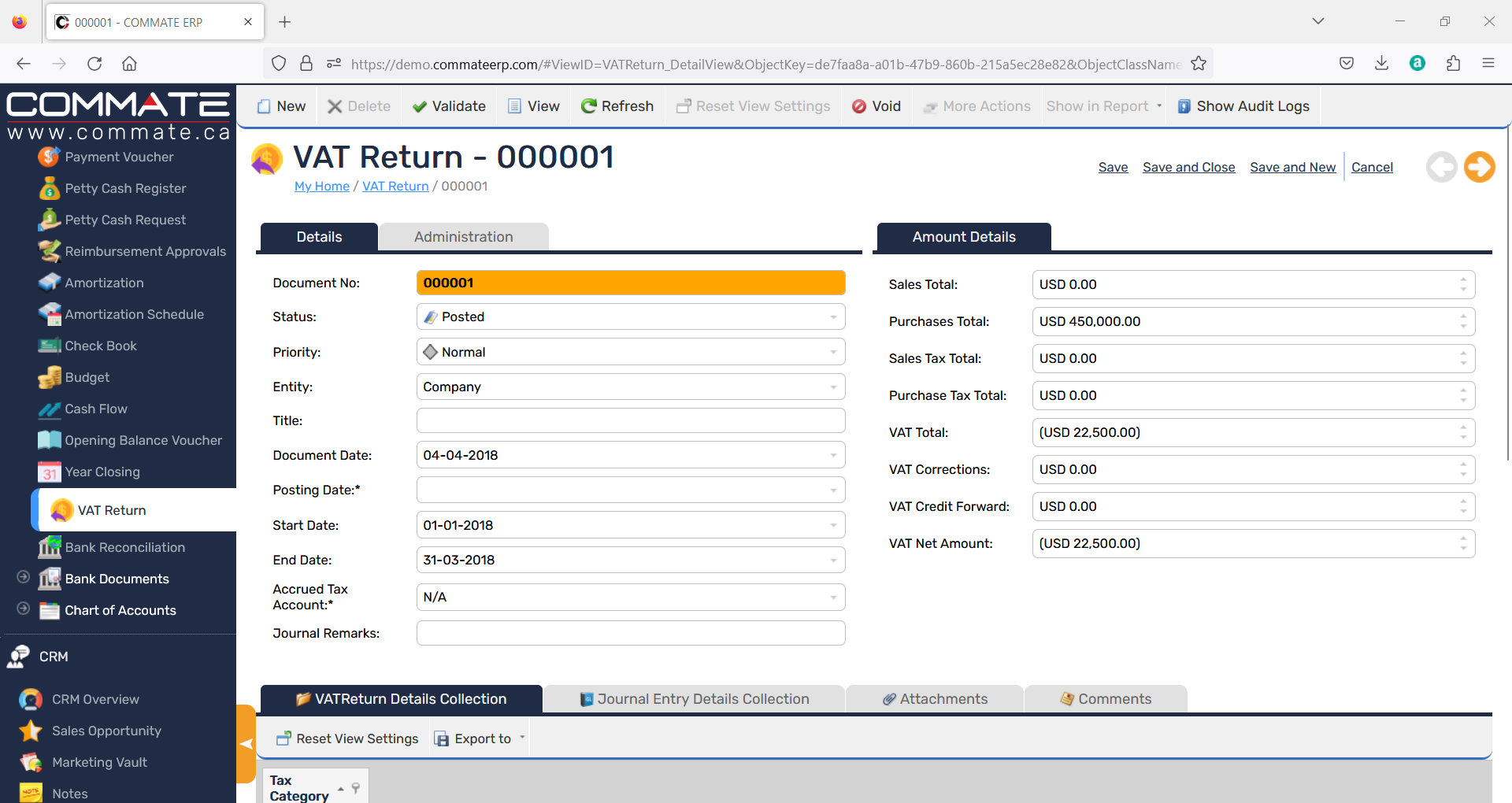

It provides a seamless and hassle-free process for managing VAT returns, eliminating the need for manual calculations and reducing the likelihood of errors.

Benefits

It involves tracking and recording VAT-related transactions, calculating VAT amounts, and preparing VAT returns for submission to tax authorities.

Features

Generate VAT Return Report in Few Clicks

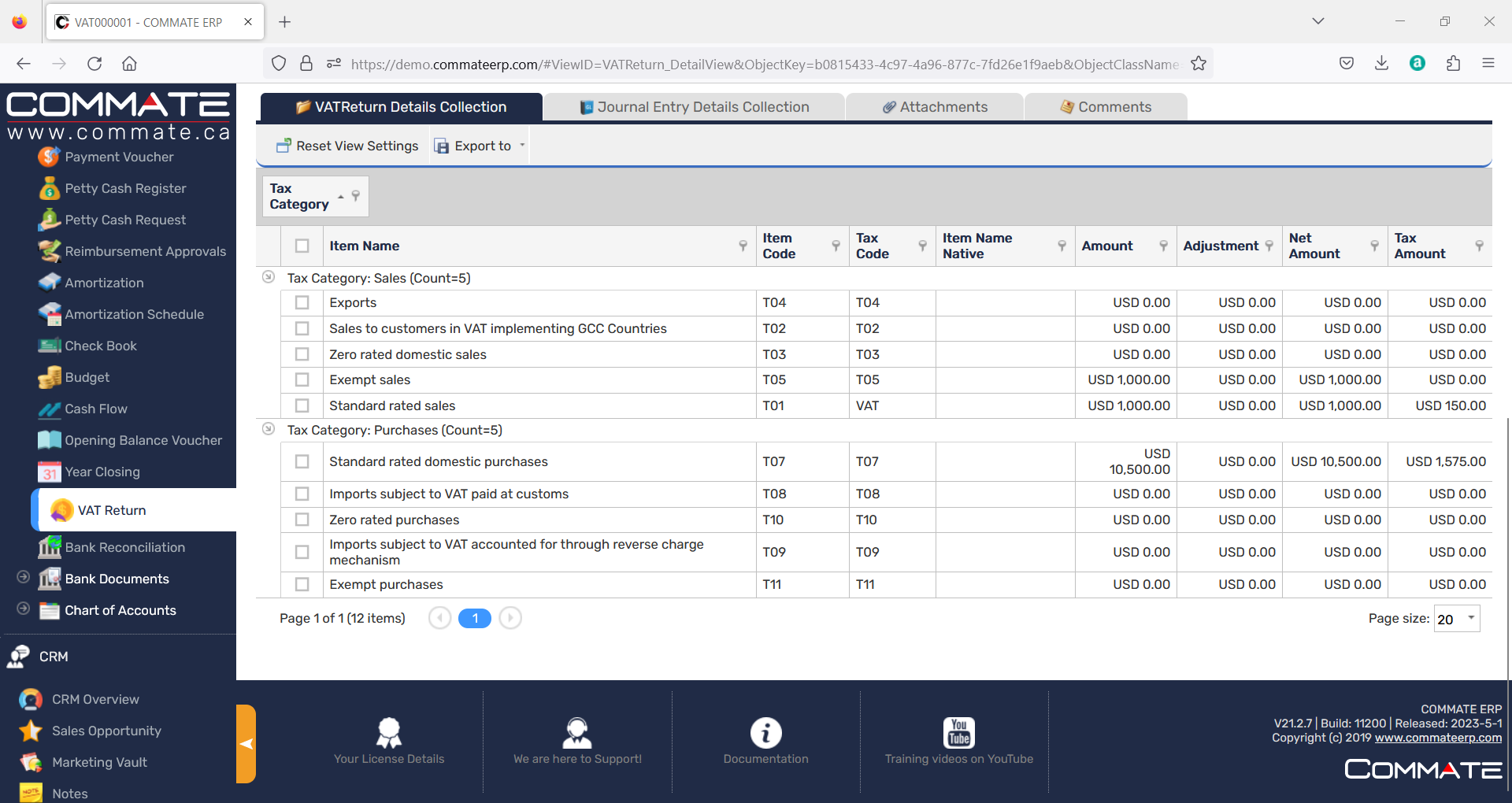

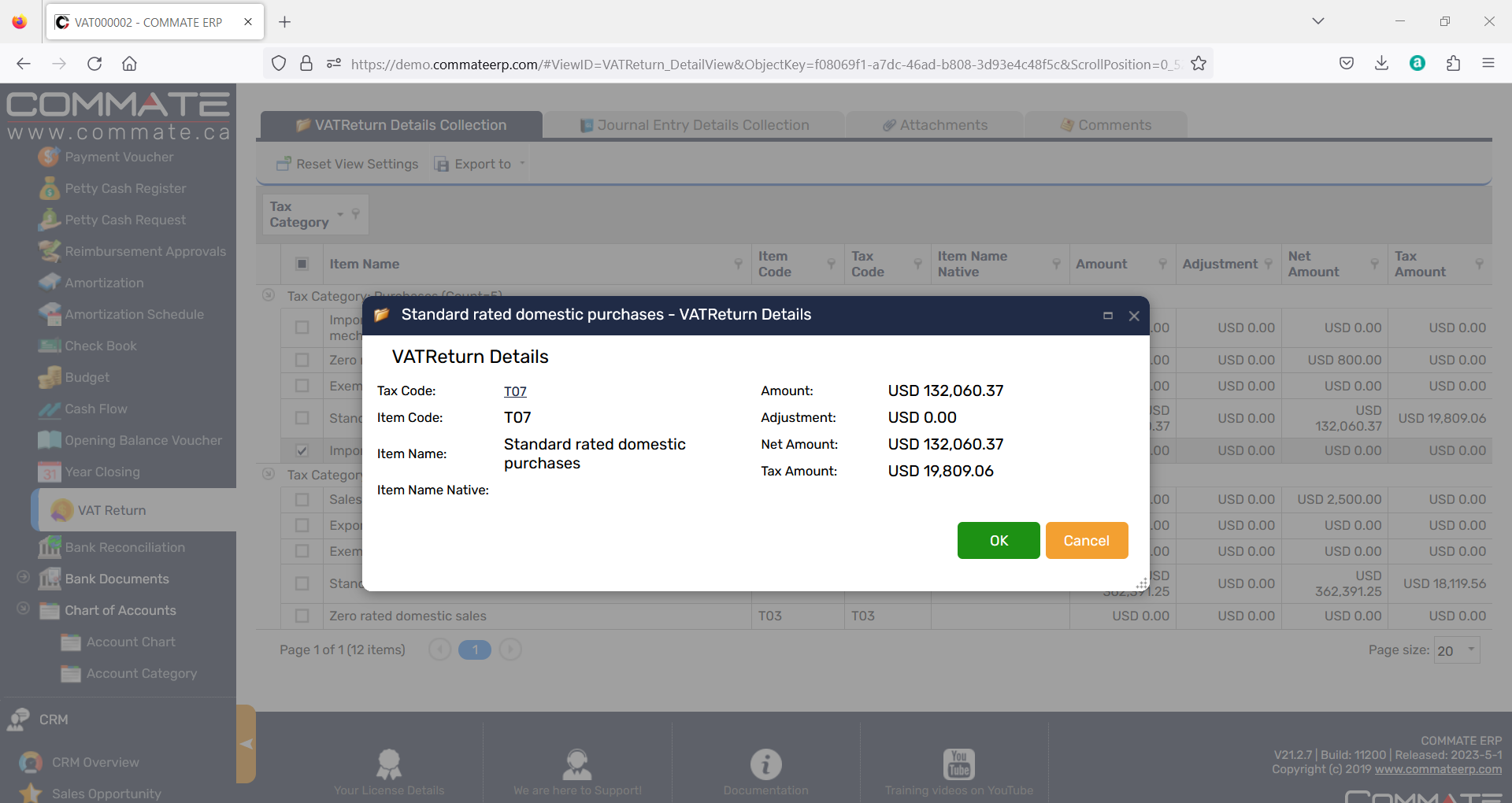

VAT Return Report with Detailed Transactions

Create VAT Categories As Per Local Regulations

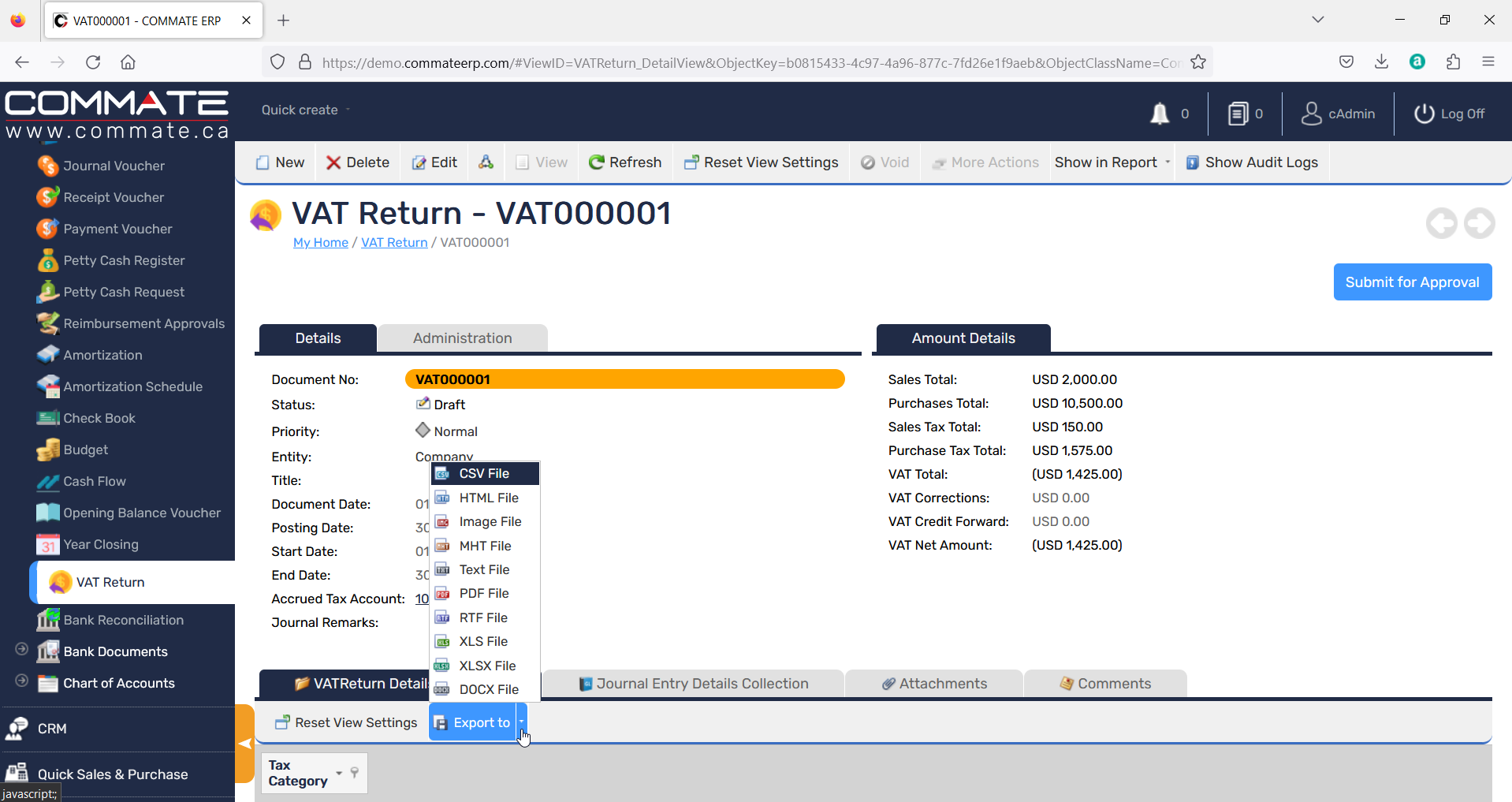

Export VAT Reports

Cyber secured by design

COMMATE is designed keeping cybersecurity in mind. It strongly takes care of many type of attacks thus making it robust & resilient. We help businesses make the digital transformation a breeze & with the Cybersecurity-by-Design incorporated in COMMATE, you can securely access your business anytime, anywhere!

RESILIENT TO DDOS ATTACKS

RESILIENT TO SQL INJECTIONS

RESILIENT TO CROSS SITE SCRIPTING ATTACKS

RESILIENT TO MAN-IN-THE-MIDDLE ATTACK

RESILIENT TO REMOTE CODE EXECUTION

FULLY PENTESTED

We add value to your business

Our clients have gained efficiency, transparency, mobility & many more advantages by running their business on COMMATE.

Whether you are a business owner or a manager or an employee of a company, COMMATE will help you get more than what you have been getting today.

Get in touch with us. We will help you understand how you can increase efficiency of your business operations by using COMMATE!